In this blog post, I explain some basic financial parameters of working as an English Language Arts public-school teacher in Tok, Alaska, and show how it relates to my situation.

In discussing these aspects of my situation, you’ll get an idea of the challenge that I must overcome.

As a reminder, I am an author of fiction and all aspects of this series can be considered a creative work. This blog series is not intended as an accurate portrayal of my financial situation.

A Spreadsheet Overview

I’ve created a spreadsheet that shows the basic parameters of life expenses and income necessities in Tok, AK.

An important thing to point out here is that although I am in my second year of teaching at a public school, this will be my first year in Tok. I am in the process of moving right now, coming from Fairbanks.

I’ll put some excerpts in tables below, but for those who would like to see the whole spreadsheet:

Click here to view the full spreadsheet.

Excerpts for Discussion

Expense Breakdown

| Monthly | Annual | |

| Total Expenses | $4,764.52 | $57,174.24 |

| Health Ins | $219.58 | $2,634.96 |

| Car Ins | $150.00 | $1,800.00 |

| Child Exp. | $1,139.94 | $13,679.28 |

| Rent | $1,325.00 | $15,900.00 |

| Utilities | $85.00 | $1,020.00 |

| Grocery | $850.00 | $10,200.00 |

| Auto Fuel | $250.00 | $3,000.00 |

| Mobile Phone | $120.00 | $1,440.00 |

| Miscellaneous and Unplanned Expenses | $525.00 | $6,300.00 |

| Medical | $100.00 | $1,200.00 |

| Savings | $0.00 | $0.00 |

To obtain these, I relied on my financial history in my personal finance software as a much as I could.

Numbers such as “Miscellaneous and Unplanned Expenses,” are based on taking a monthly average of these types of expenses that occur over the course of a year. (Car breaks down, a family member has unexpected medical needs, etc.)

Other numbers are based on projections, or are even wild estimates.

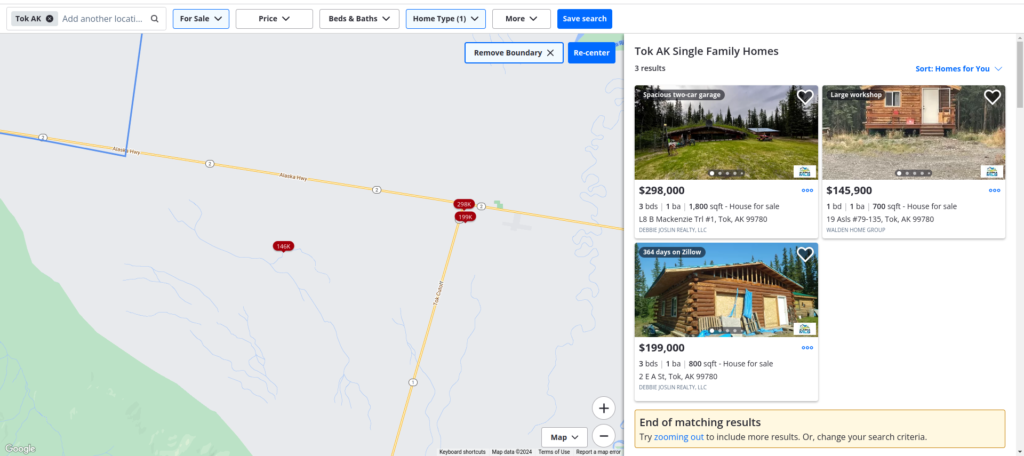

For example, the housing market on Zillow is pretty dry. If you’re curious, take a look on Zillow.

The tiny town of Tok is about to experience a mining boom, and I’m told that everyone is buying up all the property in preparation.

Therefore, I must rent an apartment (of which there are equally few options), and the prices are all quite high. The above cost is somewhere in the neighborhood of what my research indicates.

One final note to make on this table: I am not in a position to contribute to a savings account. This is the source of a bit of stress, and the desire to find a solution is an inspiration for this blog series.

Income Necessities

| Income Necessities | ||

| Required post-tax income pre-tithing | $5,293.91 | $63,526.93 |

| Required income to account for taxes | $991.80 | $11,901.60 |

| Total Required Income | $6,285.71 | $75,428.53 |

To meet the expenses as I foresee them, and when I account for other expenses that occur before I can take home a paycheck, I currently estimate that I could need a minimum of $75,428.53 per year.

You can look at the earlier linked spreadsheet to see more details about how I arrive at that number.

I may also come back later and explain what I mean by “tithing.” In short, paying a certain portion of my income to my church is a religious obligation.

The Big Problem

Finally, time to extract that bee from my bonnet.

How much money does a teacher in Alaska actually make in my pay grade?

To find that number, we can turn to what’s called a “Negotiated Agreement.” This is the collective bargaining agreement that teachers make with their school districts to determine teacher contractual pay.

Teachers are awarded based on their years of experience and the amount of education they have completed since earning their bachelor’s degree.

Here is the negotiated agreement for the Alaska Gateway School District.

I’m in my second year of teaching at a public school in Alaska, and I expect to have +36 credit hours of post-bachelor education recognized as a part of my contract.

Therefore, I am hoping to receive at least $61,667.95 as my base salary pay.

Remember that to meet my expenses, as shown in the table above, I need around $75,428.46 as a baseline. That’s already more than ten-thousand dollars below what I need.

To add to the stress, teaching jobs in Alaska are exempt from social security payments (yay?), and therefore also do not earn social security benefits (darn?). Instead, teachers must make a mandatory eight percent retirement contribution to the Alaska Teacher Retirement System (okay?).

After my mandatory retirement contribution, I therefore hope for at least a baseline pay of $56,734.51.

The total deficit that I currently project for this coming year therefore is $18,693.94.

Oh boy.

Click here to go to the next post in this series.

Ways That You Can Help

Here is a link to a blog post that describes how a supportive reader can help me in my quest.

In short, you can…

- Like, comment and share

- Buy a copy of my children’s novella, Westly: A Spider’s Tale

- Help me connect with part-time and contract work

Edit Notes

July 20, 2024: Added additional commentary to make it more clear that this blog series is only inspired by my experience; it’s not intended as an accurate portrayal.

1 comment

Comments are closed.